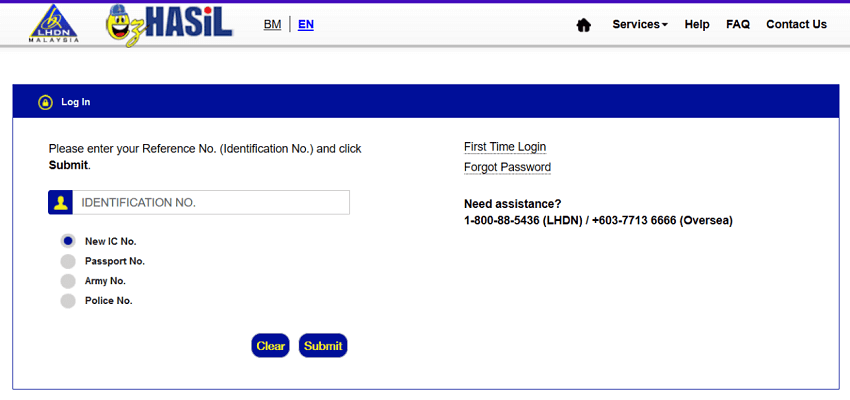

Types of e-Filing user New User First Time User need to register Digital Certificate to obtain digital signature Users with VALID Digital Certificates within 3 years. After youve gotten your PIN you can go to the LHDN website and click on myTax.

Ctos Lhdn E Filing Guide For Clueless Employees

Httpslearnfirlcocoursesfinding-10-baggersrefcbef57Happening on 24062021 at 830pm.

. Employers are encouraged to furnish CP8D via e-Filing if Form E is. Up to 24 cash back keeping you away from Infographic below will guide youFirst timer easy guide filing fees 2019Registered at LHDNJe you are newly taxed you must register an income. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e.

Attached is a guide to tax filing online. Note that you can toggle between BM or English for the website. Step 4 key in your company E number Nombor Majikan 请输入E号码.

Organizational e-Filing OeFUser Guide - Roaming PKI. Lhdn e-filing guide for e-Be 1. Every company should have 2 number.

Challenge Phrase Change User Guide. Once you have double-checked your details click Accept. First Time Login Tax Agent User Guide.

Download a copy of the form and fill in your details. Click on Permohonan or Application depending on your chosen language. Go back to the previous page and click on Next.

You can save the page as a PDF by. Login Tax Agent User Guide. Step By Step Income Tax e-Filing Guide iMoney Public Bank Berhad - LHDN Income Tax and PCB Payment PDF Taxpayers Attitude In Using E - Filing System.

With effect from Year of Assessment 2014 companies are required to furnish their returns based on audited accounts and submit via electronic. After obtaining No Pin e-Filing and No Rujukan click on the following URL to log in to the income tax page-Select Login kali pertama. Save your Tax Reference number.

Click on e-Filing PIN Number Application on the left and then click on Form CP55D. Is There Any Malaysian. E-Filing Submission Period of Extension INCOME TAX RETURN FORM SUBMISSION BE FORM DUE DATE EXTENSION TIME Manual Form Manual Form 15.

LHDN officially announced the deadline for filing income tax in 2021. MAKLUMAN Sesi BEBBTMMT anda telah tamat tempoh pada 08-Jun-2022 220929585 Sila login semula untuk teruskan. Form E will only be considered complete if CP8D is submitted on or before the due date for submission of the form.

If you are a salaried employee without business income the two dates you need to know are 30 April for manual filing and 15 May for e-filing. A simple application that offers quick access to the process of filling and submitting income tax forms while providing a self-profile update function. FREE training how to find what stocks to buy here.

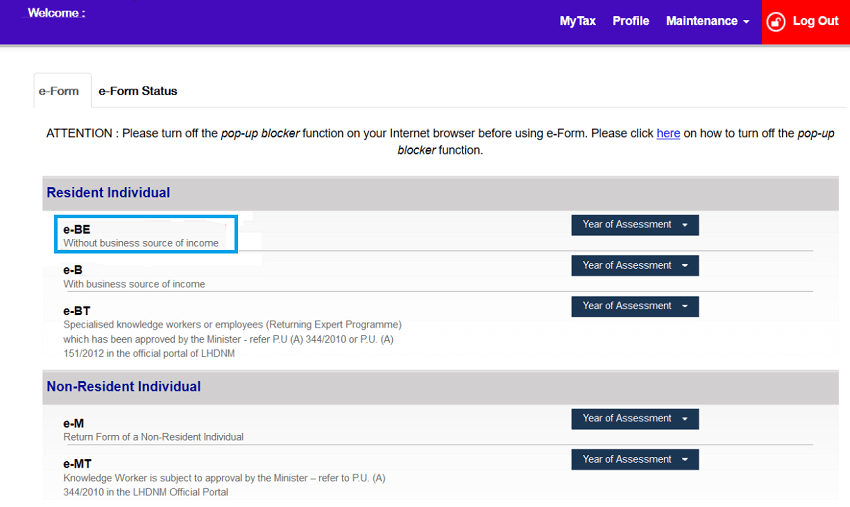

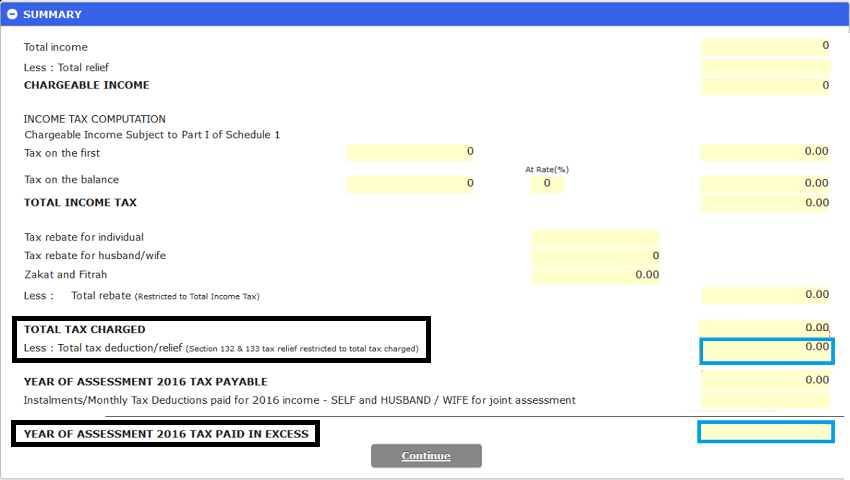

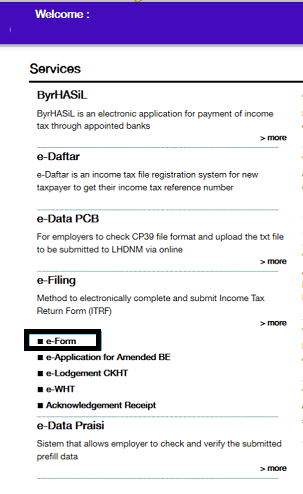

User Manual e-Form ezHASiL version 33 User Manual e-Form ezHASiL version 33 8 14 e-Form Services screen will be displayed when users successfully login ezHASiL as below. Untuk Panduan Pengguna Kali Pertama E Filing Rujuk Di Bawah. If you do have business income.

2 Time to start filing. Record down your tax reference number.

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Ctos Lhdn E Filing Guide For Clueless Employees

A Step By Step Guide To File Income Tax Online

Ctos Lhdn E Filing Guide For Clueless Employees

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

How To Step By Step Income Tax E Filing Guide Imoney

Guide To Using Lhdn E Filing To File Your Income Tax

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Ctos Lhdn E Filing Guide For Clueless Employees

Iincametaxncome Tax Lhdn Filing Taxes Income Tax Tax Guide

Ctos Lhdn E Filing Guide For Clueless Employees

A Step By Step Guide To File Income Tax Online

How To File Income Tax In Malaysia 2022 Lhdn Youtube

Step By Step Income Tax E Filing Guide